us germany tax treaty interest income

A New Certainty Under The Germany-US Tax Treaty Götz Wiese Stefan Süss Latham Watkins LLP Latham Watkins LLP Law360 New York July 31 2014 1015 AM ET -- In a recent judgment file no. On 24 March 2022 the Double Taxation Agreement DTA between Guyana and the United Arab Emirates UAE.

Section 80tta Tax Benefits Nri Can Claim 10 000 Inr On Interest Of Saving Account Nri Saving And In Investment Tips Savings And Investment Savings Account

The United States Germany Tax Treaty covers double taxation with regards to income tax corporation tax and capital gains tax.

. Corporate Income Tax Rate. Article 11 1 of the United States- Germany Income Tax Treaty generally grants to the State of residence the exclusive right to tax interest beneficially owned by its residents and arising in the other Contracting State. For married couples the filing threshold for joint returns increases to EUR.

277826 euros and more. The tax treaty serves to benefit citizens and residents from Germany who reside in the United States and vice-versa. Income covered by the tax treaty is taxed at 0 and all other income is taxed at the graduate rate for federal tax purposes.

On June 1 2006 the United States and Germany signed a protocol the Protocol to the income tax treaty between the two countries as amended by a prior protocol the Existing Treaty. Under US domestic tax laws a foreign person generally is subject to 30 US tax on a gross basis on certain types of US-source income. The German-American tax treaty has been in effect since 1990.

Article 11 of the United States- Germany Income Tax Treaty deals with the taxation interest. This percentage increases up to 2020 by 2 per year and from then on by 1. The double taxation treaty or the income tax agreement between Germany and the United States of America entered into force in 1990 and it serves as an instrument for the abolition of double taxation on income earned by US and German residents who do business in.

I R 4812 the German Federal Fiscal Court has commented on Art. First to avoid double taxation of income earned by a citizen or resident of one country in the other country. A receives in the year 2018 his.

Most importantly for German investors in the United States the Protocol would eliminate the withholding. 7 of the new tax treaty between Germany and the US. In the year 2005 only 50 of the payment was subject to German income tax.

Germany income tax law. US persons making payments withholding agents to foreign persons generally must withhold 30 of payments such as dividends interest and royalties made to foreign persons. Corporate Capital Gains Tax Rate.

Signed the OECD multilateral instrument MLI on July 7 2017. Taxation begins at EUR 8004 single individuals. Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev.

Bank account by an American residing in Germany will be taxable in Germany under the USGerman tax treaty. The treaty has two main goals. The United States and Germany entered into a bilateral international income tax treaty several years ago.

The double taxation treaty or the income tax agreement between Germany and the United States of America entered into force in 1990 and it serves as an instrument for the abolition of double taxation on income earned by US and German residents who do business in. Interest paid to non-residents other than on convertible or profit-sharing bonds and. Tax Treaty News.

Aa income from dividends within the meaning of. Return and a foreign tax credit can then be claimed. Progressive rates from 14-45.

B There shall be allowed as a credit against German tax on income subject to the provisions of German tax law regarding credit for foreign tax the United States tax paid in accordance with the law of the United States and with the provisions of this Convention on the following items of income. Zhang must provide Form 8233 for the income which is exempt under the Chinese tax treaty and a W-4 labelled NRA for any income paid on top of the first 5000 which are covered by the tax treaty. The income must also be reported on the US.

In the year 2040 the percentage will be 100. Over 95 tax treaties. On 29 March 2022 the United States US Senate approved the Double Taxation Agreements DTAs with Chile for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income.

And second the treaty helps to promote residents of either country from avoiding taxes. Without treaty protection Russian investors in the United States would be subject to 30 of the US. For example interest earned on a US.

In Germany taxable income is income from employment after the standard deduction and any other deductions are taken. The purpose of the Germany-USA double taxation treaty. The Protocol was signed Thursday in Berlin.

Individual Capital Gains Tax Rate. When it comes to real property income the Germany US Tax Treaty provides that any income generated from the real property situated in one of the contracting states may still be taxed in that state in other words for example if a US person resides in the United States and has an income generated in Germany then Germany can still tax the income even though the person is a. This table lists the income tax and withholding rates on income other than for personal service income including rates for interest dividends royalties pensions and annuities and social security payments.

Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation and the Prevention of Fiscal Evasion with respect to Taxes on income and Capital and to Certain Other Taxes together with a related Protocol signed at Bonn on August 29 1989. The Text shows the Convention between the United States of America and the Federal Republic of Germany for the Avoidance of Double Taxation with Respect to Taxes on Estates Inheritances and Gifts as amended by the Protocol to the German American Treaty generally referred to as the Germany-US. Summary of US tax treaty benefits.

For most types of income the solution set out in the Treaty for US expats to avoid double taxation in Germany is that they can claim US tax credits against German taxes that theyve paid on their income. Withholding tax on US-source dividends and related-party interest paid to residents of Russia. The purpose of the treaty is to provide clarity for certain tax rules impacting citizens and residents of either country on matters involving cross-border income.

Estate and Gift Tax Treaty.

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Taxation Of Income From Cross Border Interest

United States Germany Income Tax Treaty Sf Tax Counsel

Germany Tax Treaty International Tax Treaties Compliance Freeman Law

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

International Taxation And Luxembourg S Economy In Imf Working Papers Volume 2020 Issue 264 2020

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Savings Investment Tips 10 Points On Public Provident Fund Ppf Investment What Every Indian Investment Tips Savings And Investment Public Provident Fund

Taxation Of Income From Cross Border Interest

Difference Between Re Issue And Renewal Of Indian Passport Nri Saving And Investment Tips Investment Tips Savings And Investment Investing

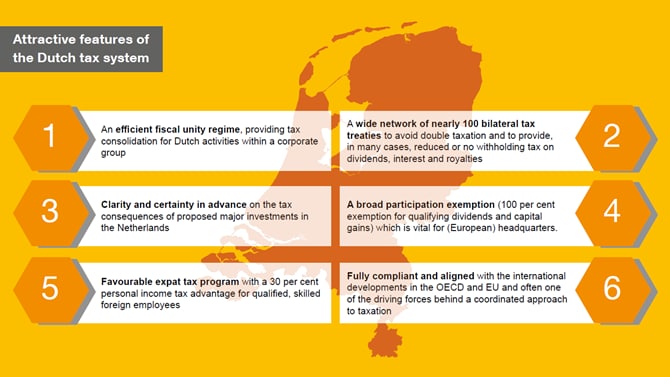

Taxation In The Netherlands Doing Business In The Netherlands 2021 Pwc Netherlands

Tax Treatment Of Interest For Corporations Ibfd

Corporate Tax Report 2022 Germany

What Is The U S Germany Income Tax Treaty Becker International Law

Doing Business In The United States Federal Tax Issues Pwc

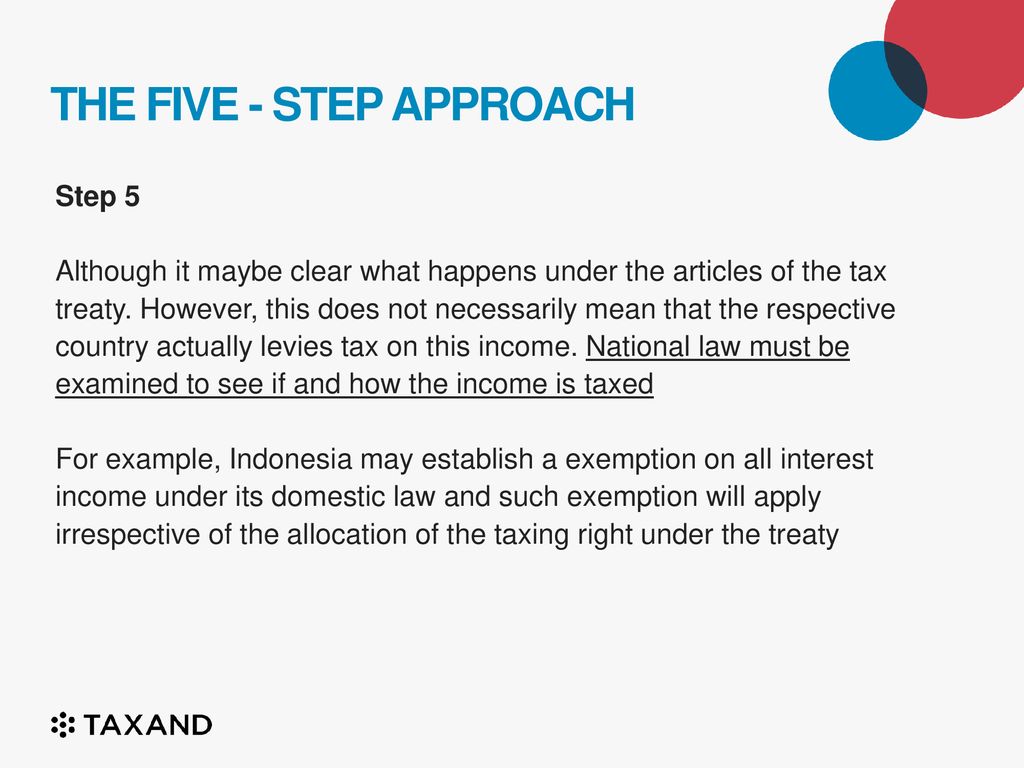

Introduction To Tax Treaties Ppt Download

The 7 Best Languages For Business How To Speak Spanish Language Learn Mandarin